The global landscape for deals is increasingly coming under pressure. With significant rises in interest rates hampering Private Equity and GBP’s strengthening against USD slowly eroding the attractiveness of inward investment from the United States for most of 2023 with the USD showing strength over August and September. These factors are causing many deal makers to get increasingly creative to get deals over the line.

Carve-outs have become an increasingly important tool for buy and sell side parties. They provide an alternative avenue for buy-side parties looking to get deals done, with the opportunity to execute value creation plans and turbo charge previously under-invested assets.

With the FTSE 350 trading at approx. 2019 levels, the use of carve-outs may be more attractive to large corporates as a means of generating capital, allowing de-leveraging or investment in strategic priorities.

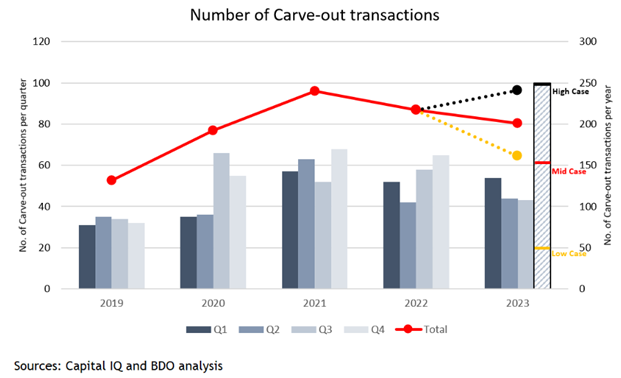

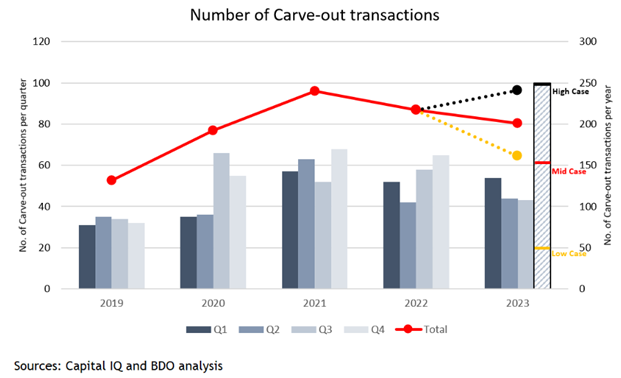

From 2019 to 2021, BDO’s analysis shows a sharp rise in the number of carve-out transactions in the market. Since then, we have seen a minor decline in volumes, however based on the factors outlined above we believe an outcome between the low to high case is likely in Q4 2023.

When to consider a carve-out?

Strategic reasons groups may consider carving out entities include:

- Need to raise cash – often to fund a wider Group turnaround programme

- Elimination of a non-core distraction - removal of an underperforming business that is requiring disproportional Group management time

- Maximise shareholder returns – if a standalone division can command a higher valuation multiple than the core remaining business

- Growth cycle variations – if a particular area of the business has achieved its potential and requires significant investment for the next business cycle, it may be time to carve it out to focus on the core business

What are the key success factors for the seller?

Corporate carve-outs involve the divestiture of part of a business or business unit from a parent company or Group. Several complexities exist in a transaction of this nature. These include:

How to maximise the value of the entity to be carved-out

The additional cost of operating the business on a standalone basis if it is acquired by a Private Equity house or firm

How any group central services are maintained in the carved-out business until full separation occurs

The cost of transitional services and defining/funding a plan to implement the separation

Addressing procurement dis-synergies as economies of scale are lost

Change of control clauses within customer and supplier contracts

To mitigate and address these issues, the Seller needs to:

- Consider value enhancements in the carved-out entity prior to sale - profit improvement opportunities encompass revenue improvement and cost base reduction;

- Confirm the deal parameter and craft the equity story of the sale;

- Clearly define a thorough separation blueprint to:

- give the Buyer’s confidence on the deliverability of the carve-out; and

- define of the standalone target operating model and cost base, including the leadership team responsible for driving the new business strategy

- Effectively communicate to all stakeholders to ensure they are informed of the carve-out process and what it means for them. This includes employees, customers, suppliers, and shareholders.

What are the typical downfalls for the seller to mitigate?

In our experience of supporting carve-outs, the key risks to the sale process include:

- Addressing the entanglements: the reliance a carved-out business has on the existing parent is easily under-estimated. If not addressed, it can lead to possible operational gaps in the new standalone business

- Avoiding unreasonable transaction timelines and insufficient resources: carve-outs are complicated and require the right amount of preparation time prior to starting the sales process. An experienced, sufficiently staffed programme management team is required to oversee the process

- Poorly defined transaction perimeter: Sellers must be precise about what is included and what is excluded from the carve-out transaction. Misalignment between Buyers and Sellers can cause break downs in negotiations quickly

- Poorly thought through separation plans: unclear implementation costs, lack of detailed project plans, limited investment in implementation resources to deliver key projects and poor commitment from the Seller give rise to a significant risk that the transaction will fall over

What are the key success factors for the acquirer?

For an acquirer, key due diligence considerations include:

- Determining a proper understanding of the standalone P&L to show the future profitability of the carved-out entity after it is separated from the parent

- Defining the future operating model from a bottom-up perspective to ensure the standalone organisation is right-sized and not overburdened with unnecessary costs - often this can yield savings as the actual cost of replicating a service in-house is lower than the group allocation charge received from a parent

- Having a clearly defined programme to implement the projects required to wean the business off transition service agreements (TSAs) is essential to ensure separation is completed before the TSA period ends. It is in the acquirer’s interest to migrate off TSAs as rapidly as possible, to minimise TSA charges and potential dual-running costs

- Assessing revenue and cost synergies where a carved-out business is being merged with an existing company owned by the acquirer

How we can help

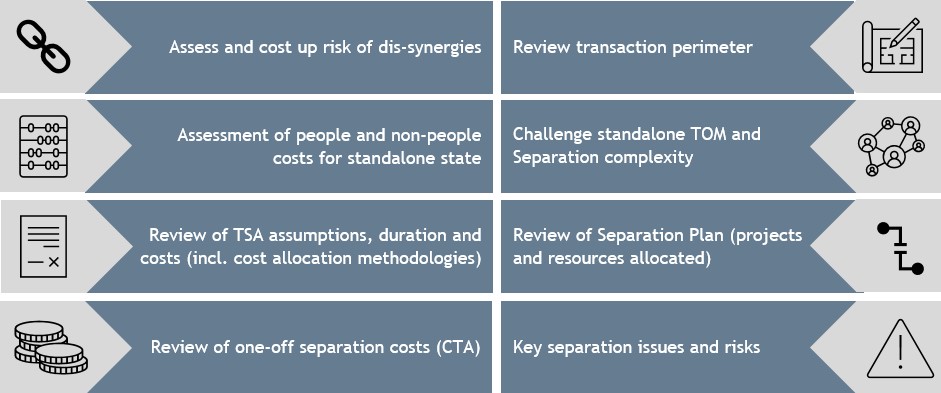

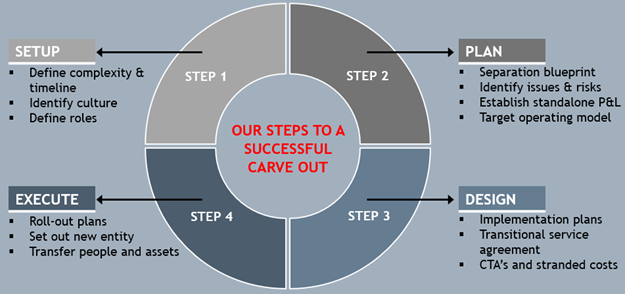

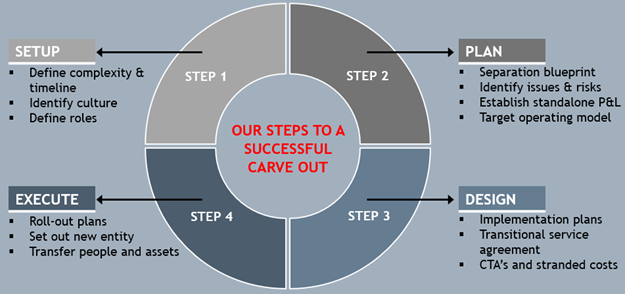

Our Value Creation Services team works alongside our M&A team to support Group management divest unwanted companies. We have experience across several business sectors and a demonstrable track record successfully completing assignments. The following graphic encompasses the key activities undertaken on a sell side assignment:

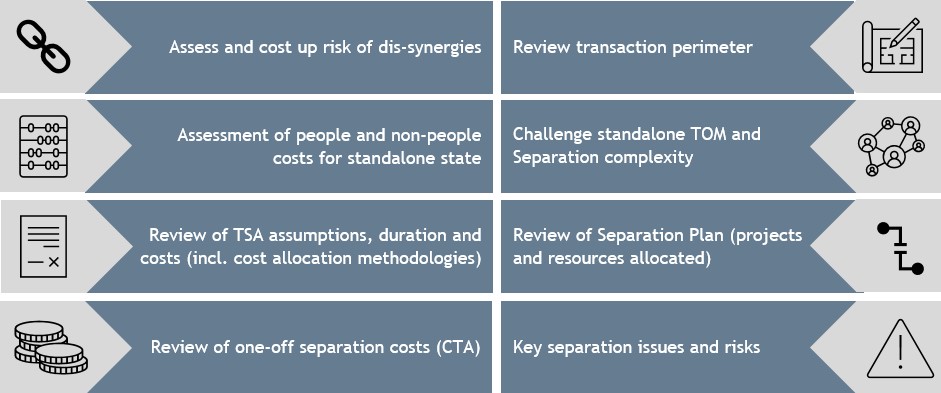

On buy side assignments, we support the acquirer to navigate various areas, including separation issues and identify key risks of complex carve-outs and how to mitigate them.

On buy side assignments, we support the acquirer to navigate various areas, including separation issues and identify key risks of complex carve-outs and how to mitigate them.

We often utilise colleagues from across the firm on our carve out assignments to provide expertise on specific subject areas. The following highlights some of these areas and key issues encountered, albeit this is not intended to be an exhaustive list:

On buy side assignments, we support the acquirer to navigate various areas, including separation issues and identify key risks of complex carve-outs and how to mitigate them.

On buy side assignments, we support the acquirer to navigate various areas, including separation issues and identify key risks of complex carve-outs and how to mitigate them.