Alex Mackay

The COVID pandemic led to a boom in Life Sciences M&A, but how is the sector faring now, and what is the outlook for deal activity?

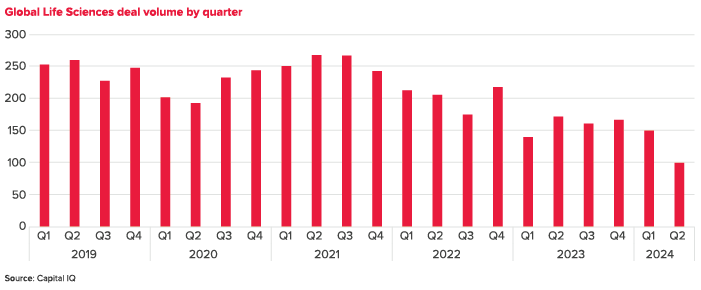

Since 2021 there has been a downward trajectory in M&A volumes. Whilst that dynamic has persisted into the first half of 2024, there are leading indicators which suggest an uptick in performance and deal activity could be on the horizon.

Pandemic deal spike, then slump

During the COVID-19 pandemic, there were many exciting developments in Life Sciences, including the development of the mRNA COVID-19 vaccines, which - alongside resilient performance in the context of a turbulent global economy - brought the sector into sharp focus. These factors, in combination with a loose monetary environment, greatly increased investor appetite for Life Sciences businesses, which led to a spike in deal activity from Q4 2020 and throughout 2021.

However, the tide began to turn in 2022. Volatility increased in the geopolitical environment and monetary policy began to tighten globally in response to rising inflationary pressures, following an extended period of near-zero interest rates.

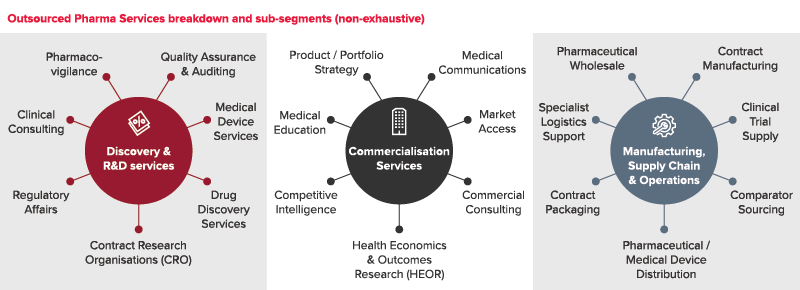

In the face of tougher economic conditions and increased costs of capital, biopharma and biotech companies took steps to cut R&D and promotional spend, as well as rationalising the use of outsourced providers across the board.

The worsening macroeconomic backdrop and renewed cost focus quickly fed through to M&A activity. Average global quarterly Life Sciences deal volumes fell from 257 in 2021 to 203 in 2022, and further to 160 in 2023.

Private equity investment, a major driving force behind deals in the sector, diminished over the course of 2022 and 2023. A difficult private equity fundraising environment combined with concerns around the sustainability of the high valuation multiples paid when the market was at its peak in 2021, resulted in investors taking a risk-focussed and selective approach to new investments.

As private equity retreated, some corporate acquirers, which had adopted a more disciplined approach to M&A strategy since 2020, seized the opportunity to reinvigorate their businesses with M&A. But overall deal volumes nevertheless continued a downward trajectory.

Green shoots in 2024

Following a bruising period of cost-cutting, tough fundraising conditions, and trading difficulties for outsourced service providers, 2024 appears to be giving way to less volatile conditions. Leading data suggests an easing of the headwinds facing the sector (and wider economy) over the last 18-24 months. Lower levels of uncertainty should lead to a more favourable economic position which will create a more positive environment for M&A.

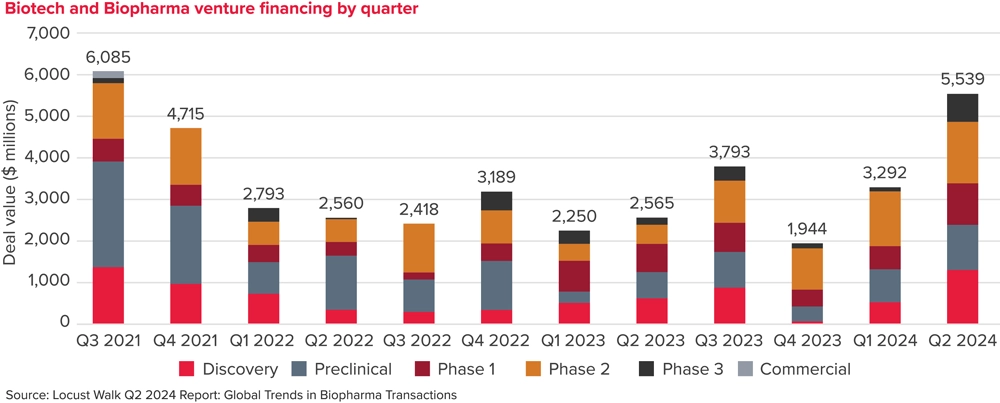

Interest rates look to have peaked in mid-to-late 2023, with rates across the US, UK and EU either reducing or expected to begin reducing by the end of 2024. Expectations around a more supportive capital environment and lower cost of capital in the near-term are already being reflected by recent data in biopharma/biotech funding levels. As shown below, deal values recovered in Q2 2024 to levels not seen since 2021.

The more favourable funding environment is positive for biopharma and biotech businesses directly, in addition to the large Outsourced Pharma Services industry supporting biopharma and biotech businesses in the development and commercialisation of new treatments.

We expect to see continued momentum in the recovery of biopharma/biotech trading, underpinned by decreased market volatility and an improved funding environment. This key trend should drive an uptick in trading performance across the wider sector, spurring confidence and providing liquidity to fund the development and commercialisation of new treatments.

Furthermore, a number of micro trends are driving continued market evolution in specific Life Sciences sub-sectors. A few examples include:

Healthier underlying funding dynamics, combined with the trends outlined above, give us confidence that the M&A environment in Life Sciences will continue to improve through 2025 and beyond. Moreover, fundamental drivers behind the Life Sciences sector remain strong, including rising healthcare costs, increasing biopharma/biotech R&D spend and ongoing outsourcing to Outsourced Pharma Services providers.

This dynamic and critical sector should be set to benefit from a return to health and predictability in 2025. If you want to find out more about deal volumes and overall M&A market performance in the UK, read our latest PCPI report.

Alex Mackay