Harry Stoakes

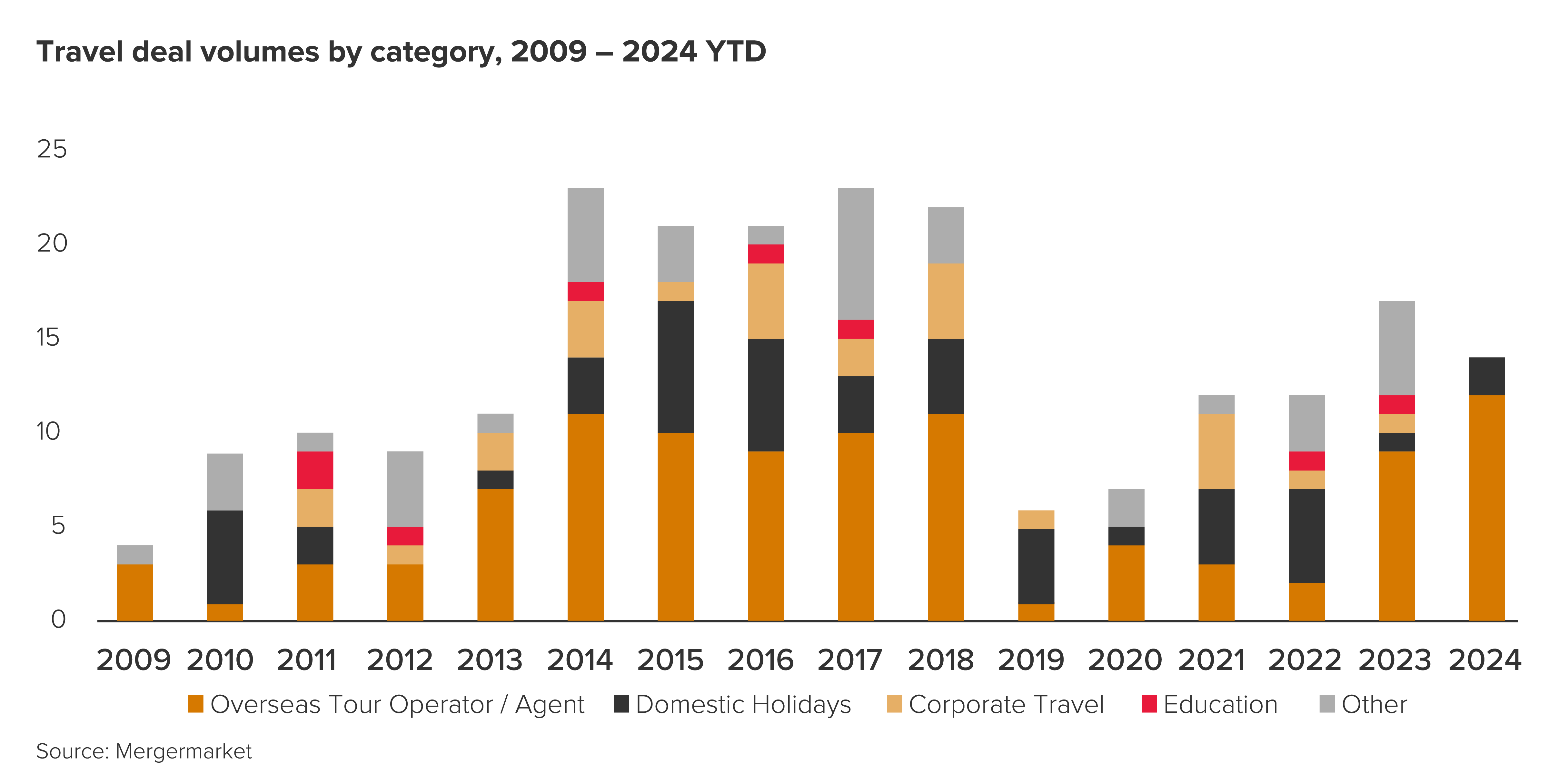

2024 has proven to be the travel M&A recovery year. COVID is long enough in the rear-view mirror to be less of a deal-bore when talking about last year’s numbers, this year’s numbers and what the business plan in the future looks like. There’s less noise now around “re-bookings” and P&Ls have been relatively clean for two years. Diligence meetings on deals this year have been focussed on booking momentum and margin sustainability rather than COVID normalisations.

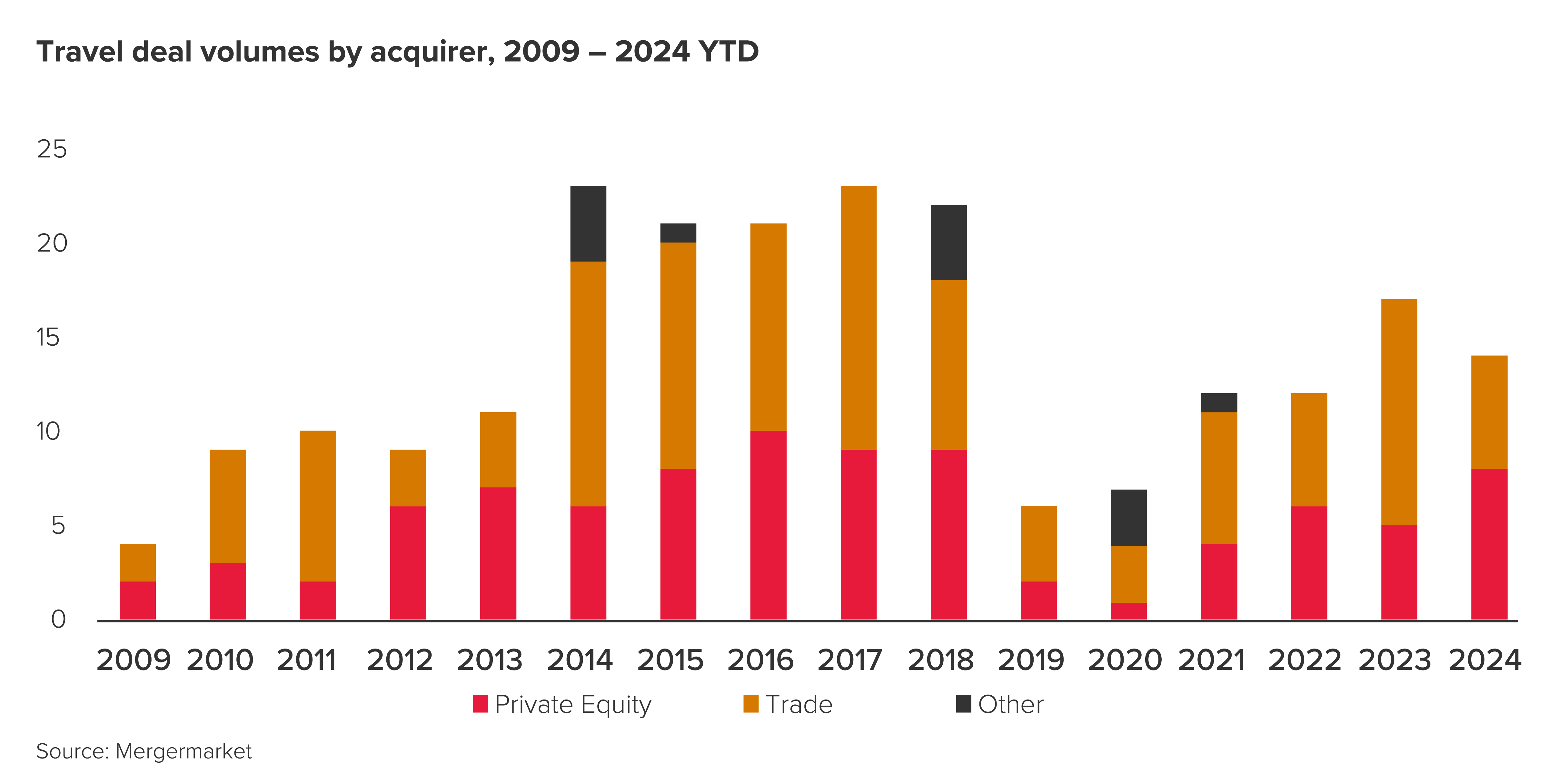

The BDO Leisure M&A team have led the deals recovery this year, advising on three sell side transactions to private equity together with buy side roles for international trade acquirers. Although deal volumes have not yet returned to the pre-COVID heyday, signals are heralding a flurry of activity in 2025.

But selling consumer-driven businesses is never easy. Consumer spend is more volatile and highly sensitive to interest rates, inflation, tax, geo-political events – of which there are many. Despite this, travel deals are back. So why is this?

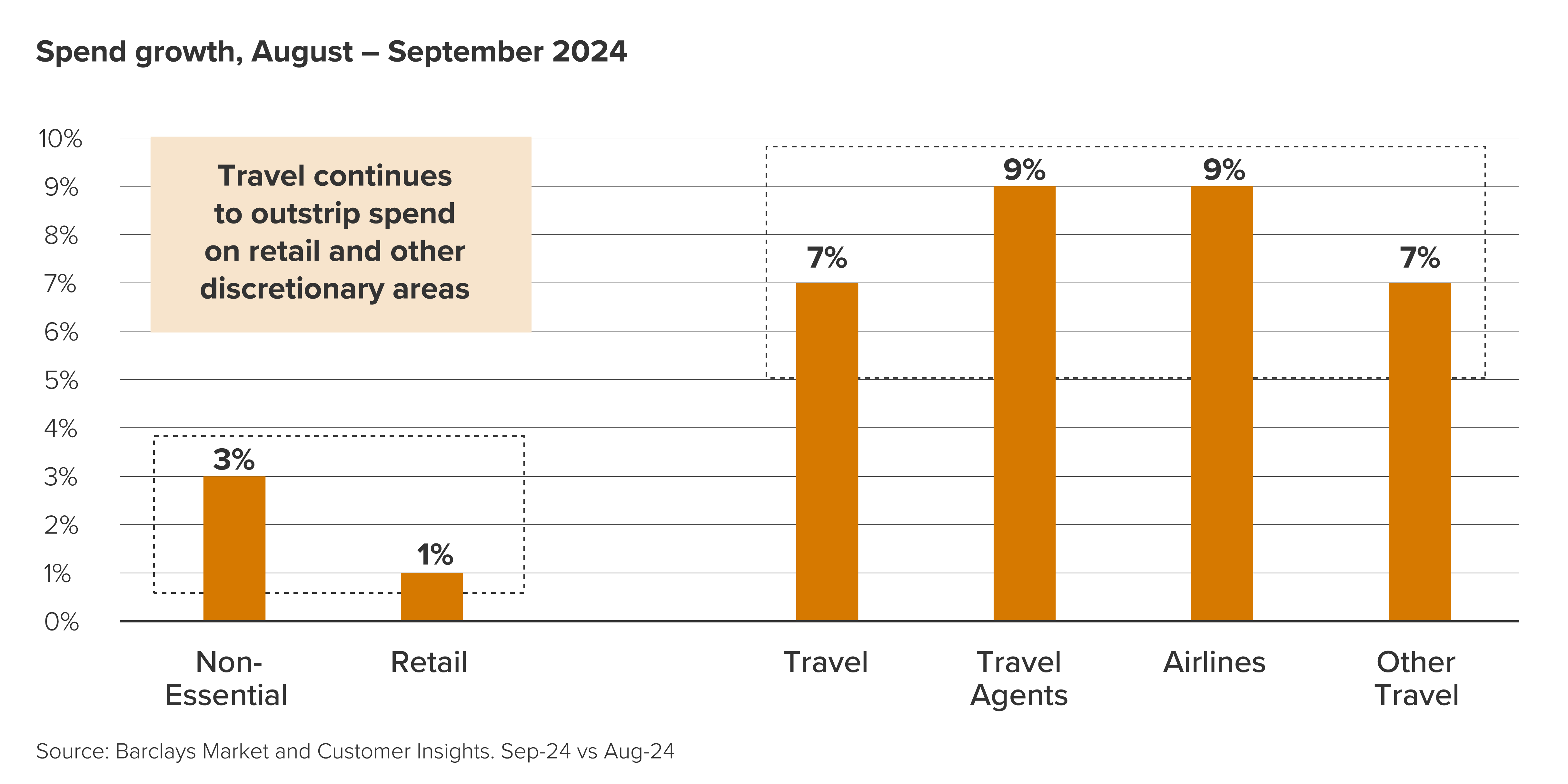

All consumer market research on the allocation of discretionary income points to a consumer that is prioritising travel experiences over all other consumption choices. Data from Barclays reveals spend on travel was up between 7% and 9% in September 2024, compared to other discretionary spending, which was up by between 1% and 3%.

The Instagram culture of “look at me” is one factor fuelling consumer demand. There is also the post-COVID adjustment which prioritises experiencing the world, new cultures and going long on fun over consuming “things” that may end up in landfill.

The paradox is travel is obviously not good for the environment, but this is easily set aside by the consumer as travel is seen as essential spend that cannot be substituted. Consumers would rather learn about how to offset their essential spend rather than give up an essential experience. At no point have we heard investors turn down a grade A investment plan on environmental grounds and one only needs to see the market cap of Booking.com and Airbnb to see this in action.

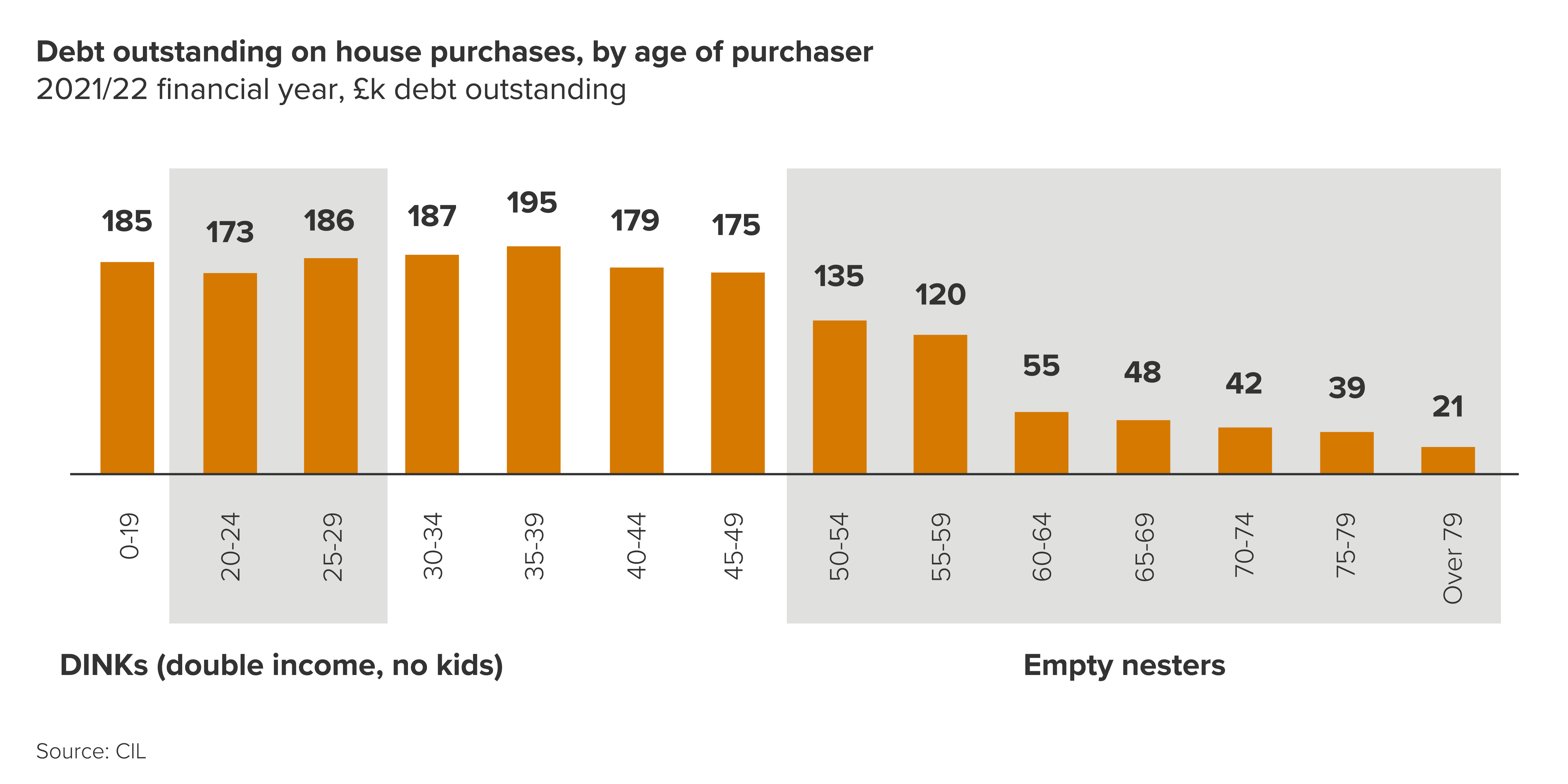

Demographic trends in the UK support the underlying growth of many of our travel clients. The over-55s age cohort is increasing in size and is much more affluent than it has ever been. The Baby Boomer generation, having benefited from exceptional house price appreciation, sits on record wealth levels. Businesses targeting this cohort have benefited from a very resilient customer base.

The story for the over-55s age cohort is a different to those in their 30s and 40s with kids and a mortgage. Here a spiking of energy costs coupled with soaring housing costs will have dampened demand.

But large operators like OTB, who are very popular with families, still reported 15% growth in total transaction value (TTV) in its September 2024 numbers. Love Holidays have increased their ATOL numbers by 50%, representing huge growth on last year.

The Travel industry had a horrific time during the COVID era. Albeit there were silver linings, including UK government support and oil prices stayed relatively low.

Tour operators have been able to skilfully remind consumers of their “safe booking with us” credentials and push up their prices while the rest of the economy was in inflation. In a landscape where consumers see price rises as "normal", margin gains have been easier to achieve for those businesses with the best tech and yield management systems. And the reduction of inflation this year to 2% is great news for all tour operators.

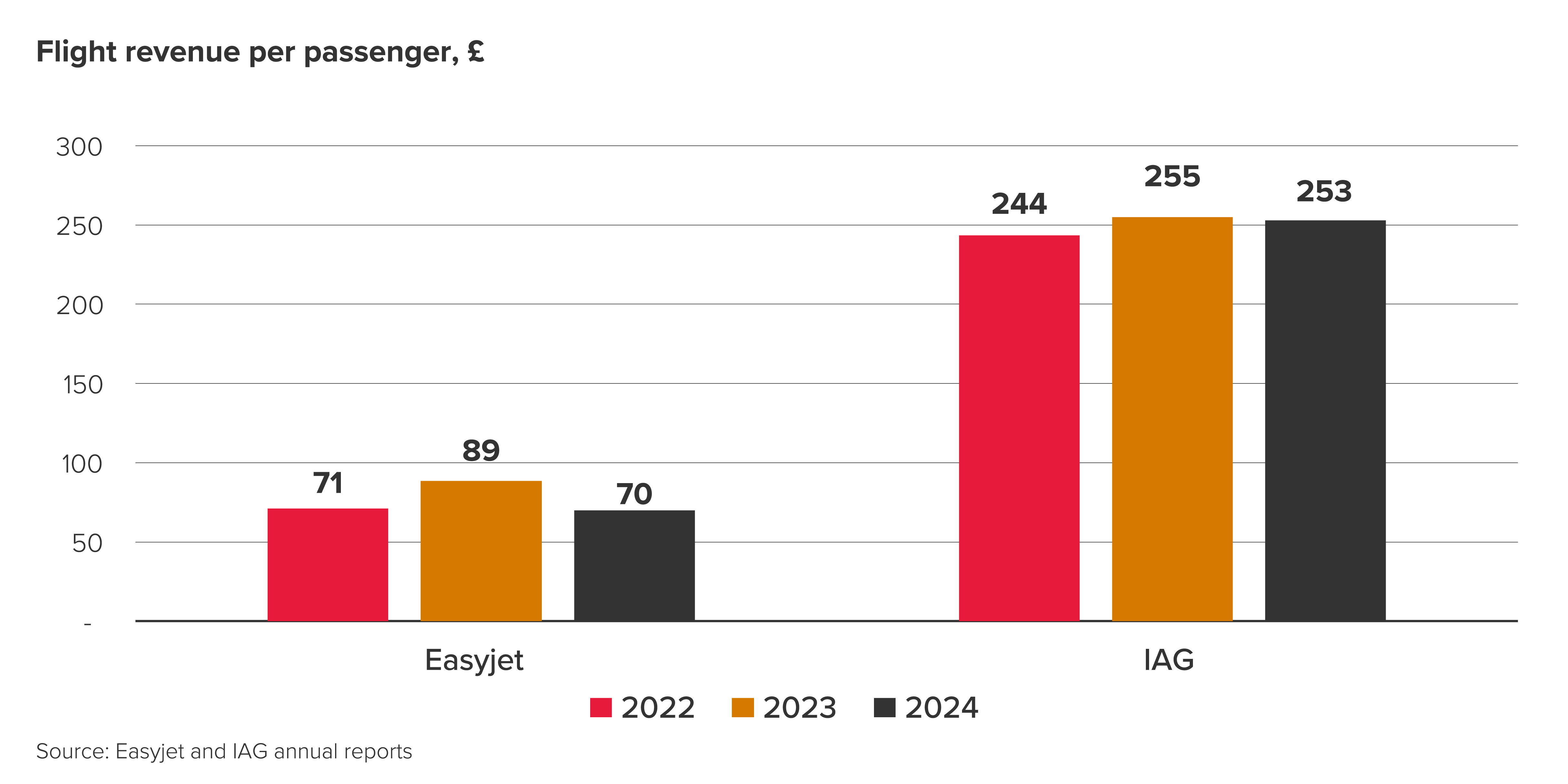

The US and Eurozone are lowering rates at a faster rate than the UK, helping Sterling continue its recent trend of appreciation. CFOs will be busy buying as much foreign currency as they can, locking in future margins benefits. CFOs will also be hoping for a lowering of flight prices as capacity recovers to pre-COVID levels. This can be seen from the average spend per passenger data below:

All these factors are driving a healthy Travel market, underpinning a return to M&A. This year we’ve advised on the sale of luxury villa holiday provider, Simpson Travel, to Risk Capital Partners, the sale of escorted tour operator, Marin Randall Travel, to Piper PE, and advised Newmarket Holidays on their investment from Soho Square Capital.

Other notable deals this year include Mobeus investing in the high growth escorted tour business Distant Journeys, and BGF investing in European DMC Vosaio. And TAG, buoyed by the international live music scene, saw investment from seasoned travel investor ECI Partners.

The debt markets have returned to support PE deals. On all our three sell sides to private equity we achieved multiple debt offers at pre-COVID leverage levels.

Valuations too are strong. While the listed market hasn’t fully recovered yet, having advised on 40 completed travel deals over the last 12 years, I can confidently say that valuations are back to where they were before COVID. It has taken four years since the dark days in 2020, but they’re back and it is great news for sellers.

IIn summary:

2025 will be a great year for Travel M&A

It doesn’t take a genius to work out that a lowering of debt costs for both businesses, deals, and consumers, will help support further M&A activity next year. The current estimates from economists support a further reduction this year and four quarter point reductions in 2025 to end next year at 3.75%.

Travel was very popular with private equity before COVID. Businesses such as Riviera, Audley and Iglu have been backed by their current investors for 8+ years and are performing very strongly. When these deals complete in 2025 (as we predict) expect further interest in travel investment opportunities after the contagion effect flows through.

So, what does good look like for anyone thinking about transacting? I would focus on four golden rules:

Get in touch with our Leisure team to understand more. And if you want to find about more about deal volumes and overall M&A market performance in the UK, read our latest PCPI report.

Get in touch with our team

Harry Stoakes