BlackRock ruling clarifies transfer pricing and unallowable purpose tests for intra-group financing

BlackRock ruling clarifies transfer pricing and unallowable purpose tests for intra-group financing

The Court of Appeal’s recent ruling in the case of HMRC v BlackRock was eagerly awaited as it has been common to set-up multiple holding companies and provide funding through these holding companies to facilitate acquisitions.

The case concerned the deductibility of interest on a $4bn intra-group loan. The Court of Appeal agreed with the Upper Tribunal (UT) no tax relief was due as interest paid by a funding company was disallowed in full under the ‘unallowable purpose’ rule (although for slightly different reasons). However, the Court of Appeal disagreed with the UT on the transfer pricing issue and concluded that the deductions for interest on the Loans are not restricted under the transfer pricing rules.

The BlackRock structure

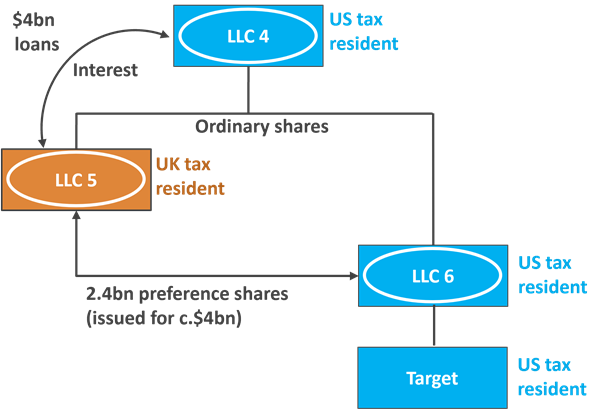

The acquisition structure was as follows:

Although LLC 5 was a US entity, it was managed and controlled from the UK, making it UK-resident for UK tax purposes, whilst claiming a deduction on the interest payable to LLC4. HMRC’s first challenge to the deduction failed at the First Tier Tribunal (FTT), as the FTT ruled that whilst there was a tax avoidance purpose for entering into the loan arrangement, there was also a commercial purpose.

The FTT concluded that, as the tax avoidance purpose did not generate any larger relief than that generated by the commercial purpose itself, the deduction did not need to be disallowed, and that LLC5 would have entered into the loan arrangement whether or not any tax relief was available.

Whilst the UT held that there was a main ‘commercial purpose’ of making the acquisition, the UT overruled the FTT finding that there was no apparent reason for the chosen UK entity to be the acquiring entity beyond that of obtaining a tax advantage and that the associated debits should therefore be disallowed in full.

Unallowable purpose

Interest paid by a company must be disallowed if the purpose of paying it fails the unallowable purpose test set out in S442(5) of CTA 2009- i.e. the purpose is one which is not amongst the business or other commercial purposes of the company. Hence, if the main or one of the main purposes of being party to a debt and paying interest is ‘tax avoidance’, then this is an unallowable purpose, and the corresponding interest is denied as a deduction for corporation tax purposes to the extent that it relates to that unallowable purpose. This is an accounting period by accounting period test and, therefore, it is of relevance not only the purpose of a company issuing debt, but also the company continuing to be a party to that debt in subsequent periods.Although witnesses (i.e. directors of LLC5) had considered the position of the company and agreed that it was a sensible commercial arrangement to enter into the loan even if UK tax relief was not available given the sizeable dividends it would receive in light of its investment, the UT stated it was appropriate to consider the whole purpose of the company (LLC5) in a wide-reaching sense when applying the unallowable purpose test. LLC5 carried out no other transactions, had no other interests or activity, and its inclusion was contrary to the usual approach of the group (which sought to ensure that all US entities were specifically not UK tax resident). Moreover, the structure (in particular the rationale for LLC being a passive investor with no active commercial role in the management of the target company) was driven by regulatory concerns with LLC5 having direct and active interest in the target company. Therefore, it is perhaps unsurprising that the UT concluded that tax avoidance was a main purpose of the inclusion of LLC5 in the acquisition structure.

Further, the UT concluded that the ‘commercial purpose’ was a by-product of the tax-driven decision to place the company in the structure, such that all the debits should be apportioned to the tax advantage main purpose and the debits disallowed in full.

Although the Court of Appeal ultimately agreed with outcome of the UT’s decision, its judgement criticised both lower courts’ route to their decisions: in particular, it confirmed that the existence of a tax deduction is not, in isolation, indicative that obtaining a tax advantage was the purpose or main purpose of the transactions. However, the Court of Appeal also cut through these considerations by saying that “in the absence of the tax advantage the decision to enter into the Loans would never have been made” and therefore concluded that the main purpose of the transaction was tax avoidance.

This case then, as with JTI Acquisition Company (2011) Ltd v HMRC, serves as a warning to taxpayers to ensure they have sufficient contemporaneous evidence to support the commercial purpose of a UK tax resident company in issuing and/or being party to a debt instrument, as well as the wider group purpose for the relevant arrangement. Clear support is required as to why any interposed intermediary is the right entity in the right jurisdiction for the corporate group as a whole to act as an acquisition vehicle and/or be party to a debt instrument.

Furthermore, where a corporate group has a choice between debt and equity, it remains vital that there needs to be a commercial purpose to choosing debt as the financing mechanism, including consideration of the ability to service the interest arising on the debt. UK corporate groups may wish to review material UK borrowings as a result to confirm that they are still comfortable with the unallowable purpose rules in light of the BlackRock decision.

Transfer pricing

When looking at the arrangements for the borrowing by LLC5, the FTT had found that while they did not include the usual covenants and guarantees that would be expected in an arm’s length transaction (ie that sufficient dividends would be paid to LLC5 to allow full payment of the interest to LLC4), such provisions were something the related parties involved would likely have agreed to, so could be presumed to have been included. The UT did not agree: it stated that only the actual terms applied between the two parties could be considered and that the actual terms were not on an arms-length basis, so failed the transfer pricing test. This would in itself have resulted in denial of the interest deduction, even absent the overlay of the unallowable purpose test.When the UT ruling was published, the main concern was that the line of argument on covenants and guarantees could be adopted in other situations. For example, there is long-standing HMRC guidance on how a ‘borrowing unit’ can be treated for transfer pricing of acquisition funding: in essence, it is acceptable to look at the borrower and all of its subsidiaries on a consolidated basis when assessing if there is sufficient income to cover interest payments and the existence of formal covenants and guarantees can be taken as read.

The Court of Appeal found that the interest deduction would have qualified on transfer pricing grounds but that this was trumped by failing the unallowable purpose test.

The ruling confirms that the definition of “actual provision” is very wide and that related parties are more likely to rely on informal understandings or non-binding arrangements than parties acting at arm’s length. The Court of Appeal noted that there is no indication in the legislation that the mere fact that an understanding or arrangement is non-binding should prevent a comparison with an arm’s length arrangement that has a similar economic effect, and which would, in practice, be legally binding. According to the Court of Appeal, the UT erred in accepting HMRC’s argument that the transfer pricing provisions do not permit the existence of third-party covenants to be hypothesised where those covenants are not present in the actual transaction. Therefore, according to the Court of Appeal transfer pricing analysis should consider the economic effect of the informal understandings or non-binding arrangements for comparability purposes.

Another point to note is that while the transactions in question occurred back in 2010-2015 and the applicable OECD Transfer Pricing Guidelines were the 1995 and 2010 versions, the judgment confirms that subsequent guidelines issued in 2017 and 2022 “simply elucidate or expand on points made in earlier versions” and so could be relied upon on that basis.

On the transfer pricing issue, the Court of Appeal decision is sensible and in line with current practice both on comparability analysis and interpretation of OECD Guidelines. This will provide some relief to taxpayers who, after the UT decision, were wondering if intercompany loan agreements now needed to mirror all terms and conditions including covenants/ guarantees, which may be unnecessary in a related party context but would normally be seen in third party agreements.

Conclusions

The Supreme Court has refused leave to appeal the ruling so it is clear that the courts are prepared to give ‘teeth’ to the unallowable purpose test. However, in Blackrock, it is hard to escape the conclusion that the only reason a UK entity was included in an otherwise US structure was to obtain a tax deduction for interest. We expect this to narrow the impact of the decision to structures similar to the one Blackrock adopted.

It is important to remember that unallowable purpose is an accounting period by accounting period test and, therefore, it is of relevance not only the purpose of a company issuing debt, but also the company continuing to be a party to that debt in subsequent periods.

The ruling is good news in transfer pricing terms and means that it will not be necessary for groups to put formal covenants and guarantees in place for all internal borrowing, i.e. previously understood practice can continue.

In the wider context, this ruling is another reminder that, when tax avoidance is alleged by HMRC, it is not a sufficient defence to say that a transaction was ‘commercial’ without proving that both the individual elements of the structure and the overall arrangements were commercial, and performing detailed comparability analysis that concludes the economic effect of the related party loan arrangement meets the arms’ length standard.

How can we help?

For help and advice on your acquisition structures and transfer pricing arrangements, please get in touch with our Transfer Pricing Team Meenakshi Iyer and Andrew Stewart; or our International Tax Team Ross Robertson and Jack McBennett.