How are CFOs adapting to the broadening spectrum of global risks?

How are CFOs adapting to the broadening spectrum of global risks?

The important evolution of the CFO

The study found that finance leaders are adopting a more holistic approach to the way they operate. Some CFOs are even redefining their responsibilities altogether - taking on the role of Chief Value Officer - as their strategic foresight becomes ever more crucial in safeguarding the organisation and driving forward the interests of the business.| " The emerging Chief Value Officer (CVO) role is much more wide-ranging and proactive, forcing practitioners to be familiar with a broad array of risk factors — from supply chain disruption to human resource shortages. If a CFO is an archaeologist, seeking patterns in records, the CVO is a futurologist, surveying a wide horizon. CFOs are not driving the lag indicators, which are the financial results — they are driving the lead indicators, which are often not financial results."

Chief Value Officer: The Important Evolution of the CFO

|

The economic uncertainty of the Covid-19 pandemic marked a pivotal moment for the finance function. As organisations turned to their finance leaders to provide advice and insight in the face of rapidly changing and uncertain circumstances, the role of the CFO was irrevocably refocused away from assessing historic data to predicting potential outcomes. This change marks a behavioural shift for the finance function, where risk is not just monitored and managed, but also anticipated and turned into opportunity.

A certainty, rather than a possibility

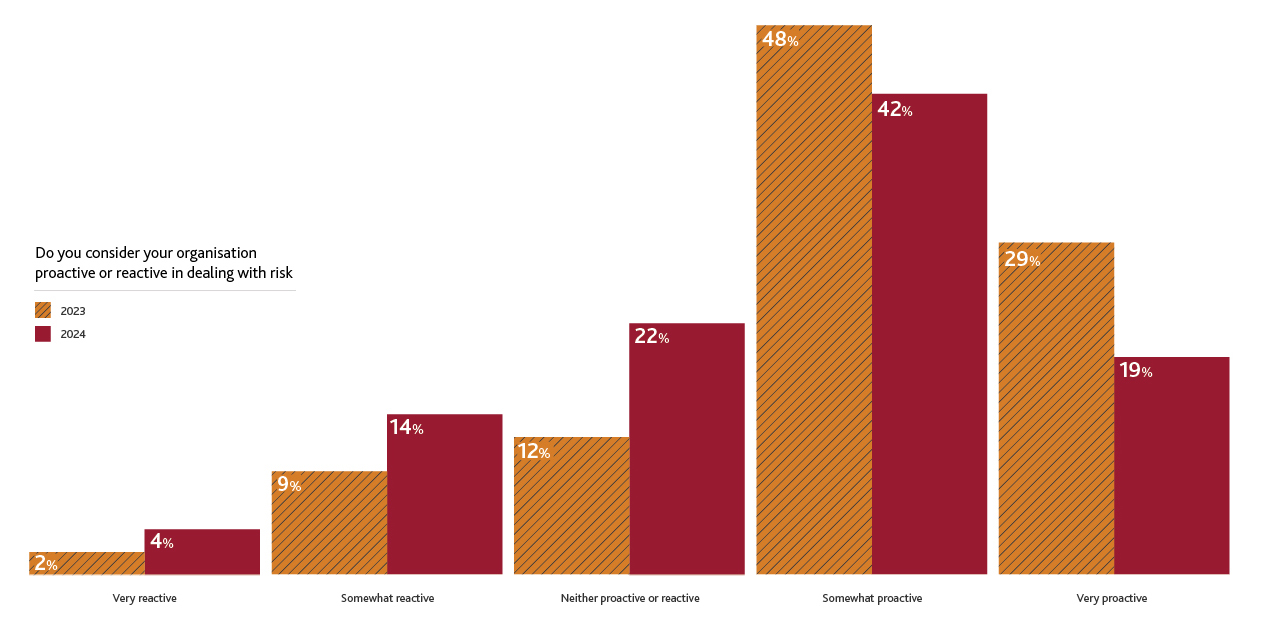

In our changing environment, risks and threats aren’t just a possibility, they are a certainty, with 60% of business leaders stating that risk velocity is increasing in BDO’s 2024 Global Risk Landscape report. As the global landscape shifts from one crisis to another, many organisations have inherited a diminished appetite for risk and a more reactive (rather than proactive) approach to dealing with it.

In this environment, it is finance leaders who are being challenged to provide the proactive support that organisations need and to consider a spectrum of risks that could impact the financial health of the business and its overall value proposition.

What are the key risk factors?

- Geopolitical tensions have a devastating impact on communities and a stifling influence on supply chain resilience.

- 69% of C-Suite leaders expect the conflict in Ukraine and the Middle East to continue for at least the next year (Global Risk Landscape Report 2024).

- Evolution of technology such as AI presents both a risk to cyber security and an opportunity to generate business value.

- 45% of C-Suite leaders say the evolution of AI will make securing your organisations against cyber-attacks easier (Global Risk Landscape Report 2024).

- Advances in technology and an increased focus on ESG and sustainability are leading to new regulatory and compliance risks that organisations are struggling to keep up with.

- 65% of C-Suite leaders said their organisations were delaying business decisions until after one or more of this year’s major elections (Global Risk Landscape Report 2024).

- Customers’ perceptions of your organisation social and environmental impact can have a beneficial or detrimental impact on the manner in which they engage with your business.

- The value you offer your employees beyond their pay checks intrinsically influences your organisation’s capability to attract and retain talent.

- Increasing expectation for the finance function to not only manage finances but also to provide strategic growth and debt advice, as well as transaction support services, marks a pivotal shift in responsibilities.

- Communicating the company's value to investors and other stakeholders

- Developing and implementing a value creation strategy

- Measuring and reporting on the company's value.

Digital transformation and a network of support

Growing pressure placed on finance leaders to deliver strategic advice relating to the resilience of the business represents a major evolution of the CFO brief, requiring a new range of skills and, likely, some digital transformation. Today, it is easier than ever to integrate data streams into dashboards for quick and easy analysis. Artificial intelligence can also be used to support the development of the finance team.However, with documented skills shortages in accountancy, it's likely that not all finance departments are currently equipped with the necessary in-house expertise to meet all these new challenges. It's here that the ability to build extended teams becomes pivotal to ongoing success.

Many finance leaders will recognise the importance of including corporate stakeholders from key functions such as procurement and human resources, as well as external advisors and service providers, to fill gaps in expertise and provide the resources they need to address an ever-evolving risk landscape.

How can we help?

By embracing digital transformation, nurturing new skillsets, and developing a strong external network of advisors and experts, finance leaders can ensure they are well-equipped to signal and respond to risks, building success in an ever-evolving economic environment.

From outsourced accounting and reporting services to finance & accounting technology support; payroll & people services to risk advisory, our dedicated teams are positioned to support finance leaders in addressing the complex challenges of today’s business landscape.

Chief Value Officer: The Important Evolution of the CFO copyright © 2023 by the Association of Chartered Certified Accountants (ACCA). All rights reserved. Used with permission of ACCA. Contact insights@accaglobal.com for permission to reproduce, store or transmit, or to make other similar uses of this document.