Lucy Sauvage

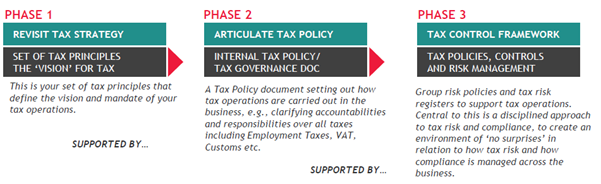

Businesses are seeing clear value in articulating their vision for tax within a documented Tax Strategy and then setting out their policies and processes that underpin this Tax Strategy. The Tax Strategy will provide a vision for the tax function by defining tax governance, the management of tax risk and tax operations across your business.

You can work with us to develop a Board-approved Tax Strategy that provides the ‘vision’ for your current and future operations. You can then publish this internally and, if you need to, externally. Your position will be strengthened by defining those expected standards of conduct in how tax is carried out in your business. This is typically set out in a Tax Policy that underpins the principles in your overarching Tax Strategy and includes all elements of your tax control framework.

We will work with you to clearly articulate your vision for tax within a Tax Strategy and then set out the policies and processes that underpin the Tax Strategy. This will be articulated in a Tax Policy document as depicted below:

We define a Tax Strategy as providing the vision for your current and future operations. You may wish or be required to publish this externally in accordance with Finance Act 2016 (see below). Typically this would be 2-3 pages setting out important tax principles, including your tax risk appetite, tax governance, approach to tax planning, relationships with tax authorities etc. It would ideally be aligned to existing ESG principles (see our Responsible Tax page).

Having a standalone Tax Strategy is not enough. You need to demonstrate that the strategy is integral to the way your business operates and embedded in your daily operations.

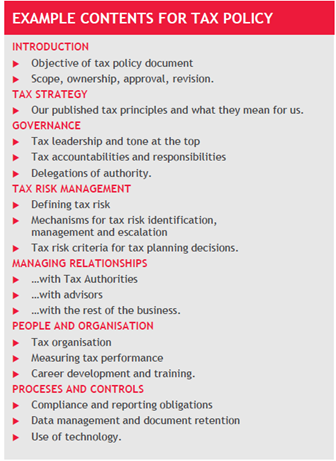

This is done by developing an internal Tax Policy, and we define this as a board approved document that sets out ‘expected standards of conduct in relation to how tax activities are carried out in the business’ -this underpins the principles in your Tax Strategy and typically includes most elements of the Tax Control Framework.

The development of a Tax Policy provides those with tax responsibilities with the mandate to clearly define and/or make changes in how tax is managed.

The content of the Tax Policy is often ‘forward-looking’ in the sense that once approved, the tax and finance function has the remit to make changes in the way that tax operates in the business.

Example contents are set out in the image below.

Your Tax Policy may include elements that are aspirational from updating tax compliance processes to formalising effective tax risk escalation mechanisms. We would determine how much of this is already in place within your business as part of Phases 1 and 2 above.

You can find out more in our “Articulating your Tax Strategy and Governance” brochure.

The 2016 Finance Act became law in September 2016. It included a requirement for certain businesses to publish online their tax strategy as it relates to UK taxation. For most organisations, this is typically a set of tax principles or short statements.

Download our practical guide to publishing your tax strategy

Lucy Sauvage

James Egert